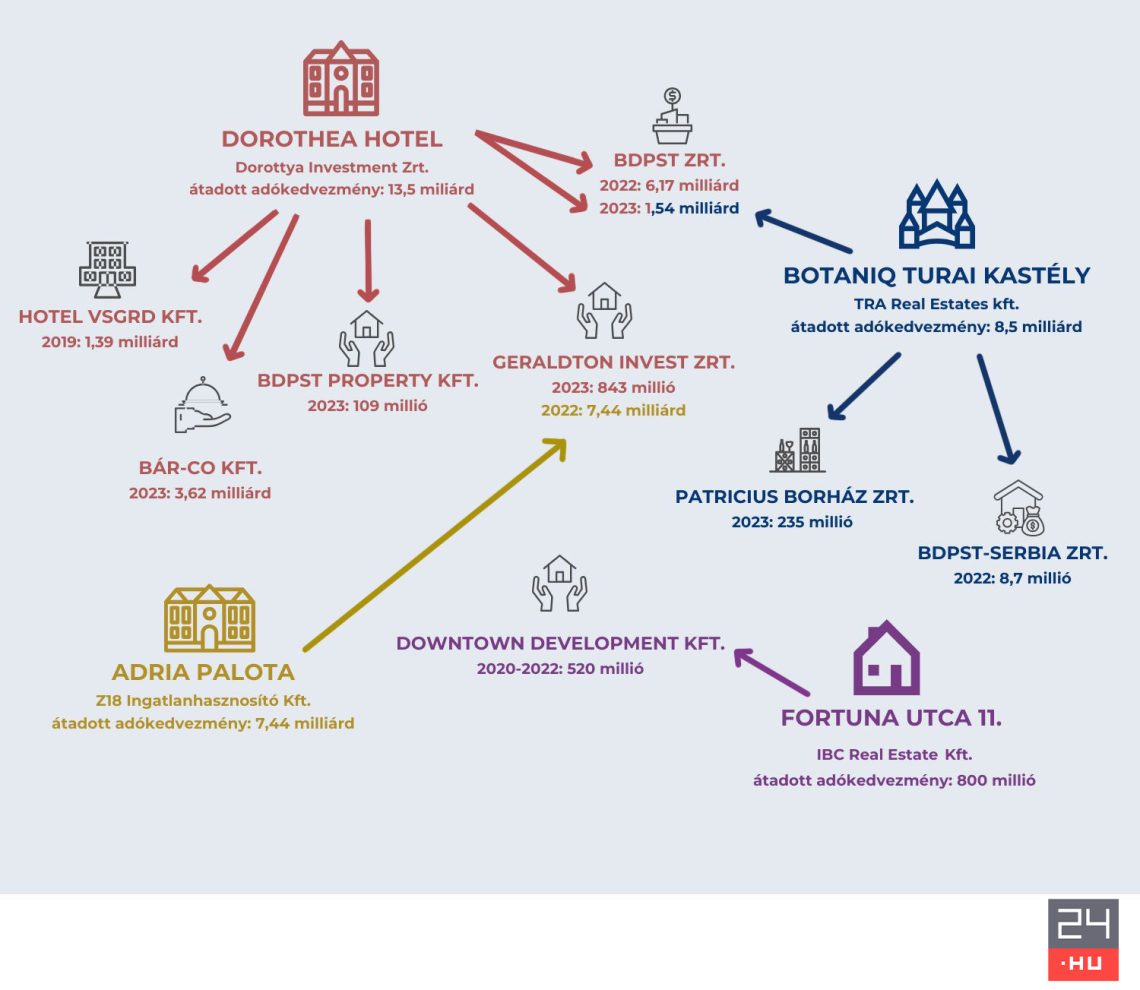

István Tiborcz, Prime Minister Viktor Orbán’s son-in-law, first appeared on the list of Hungary’s top 100 wealthiest people in 2019. Since then, his wealth has tripled, recently ranking 19th and entering the (forint) centibillionaire’s club. This growth is largely attributed to his extensive real estate empire; among other ventures, an entire hotel chain has been developed under the BDPST brand in the past five years.

Tiborcz’s central asset management company, BDPST Real Estate Management and Capital Investment Plc. – where the Prime Minister’s daughter, Ráhel Orbán, serves as creative director – has been a veritable money printing machine. Between 2019 and 2023, it

A substantial portion of this amount went to the owners, as recorded in the general meeting minutes, with 5.5 billion forints taken out as dividends. Yet, not a single penny was paid in corporate income tax.

For five years, the company has managed to reduce its tax liability to zero, a practice extending across the entire group of companies.

At the end of last year, BDPST had 16 affiliated enterprises, and the balance sheets show that of the profitable companies within the group,

An exceptional case was Geraldton Invest Plc., owner of the Gellért Hotel, which enriched the state budget with 44 million forints in 2022 – a little less than 0.2 per cent of its 25 billion HUF profit for the year. Typically, however, the group’s companies made efforts to retain even the smallest amounts of a few millions; for example, BDPST – Serbia Plc. offset a profit of 8.759 million forints – achieved in 2022, its only profitable year – with a tax deduction of the exact same amount.

Eight years ago, Finance Minister Mihály Varga proposed – as part of a tax law amendment package – to allow domestic companies to reduce their tax base by twice the investment value when renovating landmark or locally protected properties. This 2017 amendment also allowed companies to spread the deduction out over a five-year period, and in case they lacked sufficient profits, pass the deduction to affiliated companies. The deduction can be spread between parent and subsidiary companies as well as jointly managed enterprises within a given group.

These benefits can be best utilised by company groups with a substantial real estate portfolio, the means to finance landmark renovations, and a number of profitable subsidiaries. Tiborcz’s empire fits this model perfectly: it bought landmark properties in quick succession, had ample access to loans thanks to the generosity of the government’s MFB Hungarian Development Bank Plc., and weaved a network of companies to manage these transactions.